Aug 05, 2024

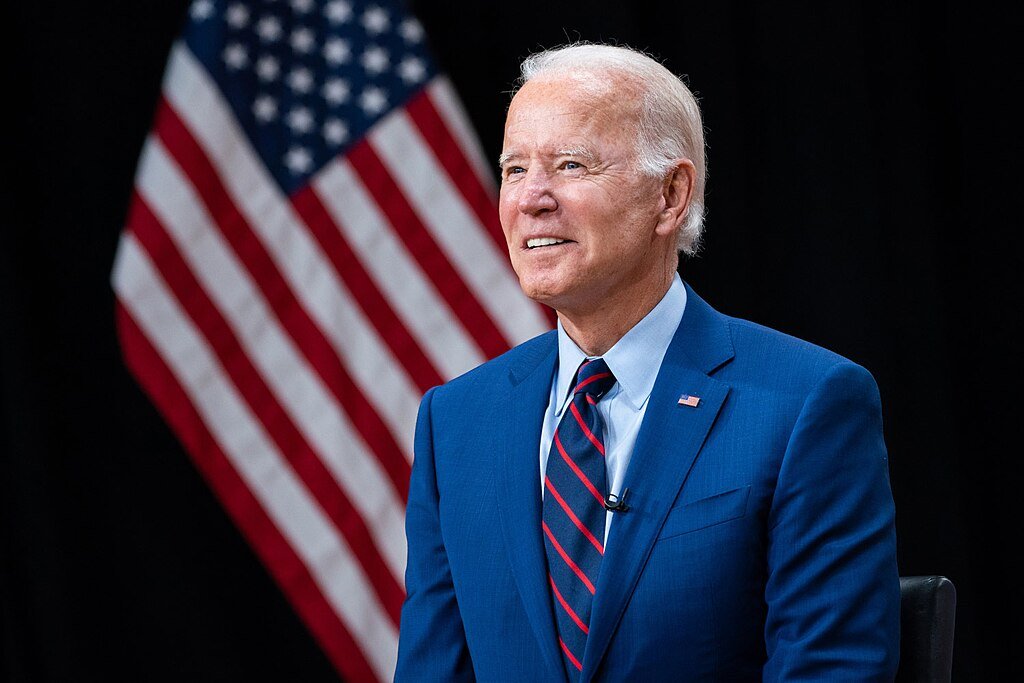

Personal finance lessons from the Biden situation or knowing when it is time to transition

Posted on:Jul 23, 2024

Sportscasting legend Bob Costas used a baseball analogy to describe what needed to happen with respect to Joe Biden. He said the United States president was like a starting pitcher who had tired out by the seventh inning and needed to be replaced by a relief pitcher.

Most starting pitchers want to stay in and might even debate a manager who tries to remove them. Nevertheless, the manager almost always replaces the pitcher. Unfortunately, Biden was like the manager, general manager and owner all in one. Only he could take himself out of the game.

Now that Biden has finally stepped aside in his run for re-election, even Democratic insiders can finally say out loud that it was the right decision. How could it be anything else? He is dramatically slowing down at 81, so how could he possibly have the most important job in the world at 85? And yet he was dangerously close to being on the ballot in November. How could that have happened?

Unfortunately, the Biden story happens in many families across Canada, although the stakes are thankfully much smaller. What I mean is that someone who is, unfortunately, no longer able to effectively manage the finances continues to do so.

It happens because the person who has long been in control of that job understandably doesn’t want to give up the ball. It happens because the family members who can clearly see what is happening know it will be a tough conversation and, in some cases, because they are truly frightened that nobody else can fill that role. In other cases, nobody wants to take on that role and will happily delay it for as long as possible.

There is no question that this is a scary and difficult situation. Whether the issue is finances, driving a car or determining if there is a better real estate situation, these can be agonizing talks.

In my career as a wealth manager, I occasionally see a smooth transition. More often than not, it takes something dramatic to make a change happen. Dramatic could mean a sudden physical or mental decline that makes change a certainty. It could also mean that you are receiving letters or calls for the first time from a utility or telecom company about bills that haven’t been paid. It can mean being almost or fully scammed, with the result being a loss of money and shame.

My goal and hope is to see a transition that is smooth. The best-case scenario is when the individual who is responsible for the finances is willing to transition. This is rare for all sorts of reasons — Biden clearly couldn’t do it without a great deal of pressure — so here are a few suggestions to help make it happen.

If you’re in charge of finances

Take a very hard look in the mirror and ask yourself if you could use some help. Remember that you have an important job, and part of doing it well is recognizing when you may need some help.

If you see that as a possibility, have a conversation with a trusted family member or adviser to see if you can plan out how you can work with someone to teach them what needs to be done. This allows you to stay involved, teach someone the ropes and ensure the next person understands why you do things the way you do. It also leverages your years of experience and being able to share your knowledge on the subject.

If you’re a family member

Try to identify who can help with financial items. Is there a family member who has power of attorney on property? Perhaps this person can get a little more involved with where things are and how things are done. They can ask questions. They can share how they are paying bills, dealing with taxes and managing investments. In short: offer to help.

If there is a wealth adviser, an accountant or someone similar, it might make sense to reach out to them to discuss things. If not, it may make sense to find someone now who can help today as well as in the years to come.

If you’re an adviser to the family

There is some responsibility to bring other family members into meetings and certain discussions. In the investment world, there is a document for a “trusted contact person.” This isn’t someone who is a legal owner of the investments, but someone the adviser can talk to in the event that the legal owner is unable to, or if there are particular concerns that may need to be addressed by the adviser.

Hopefully, between the outreach of the adviser and the outreach of the family member, there is some meaningful discussion about when things may require change.

One way to help get the conversation started on all sides is the completion of something that we call the All in One Place Guide. It is a document that records a wide range of information about investments, banking, insurance, credit cards, etc., along with notes on who to call in case the person in charge of the finances becomes incapacitated or has died.

This document should be shared with someone you trust or, at the very least, it should be discussed and a family member knows where to find it.

Another way to get the conversation started is to ask the person in charge of the family finances if they have updated their will and powers of attorney in the past 10 years. Especially as people age, they sometimes find that those named in these documents are no longer able to handle the responsibilities that are outlined.

In the case of Biden, the stakes couldn’t have been higher, yet his family and closest advisers still struggled mightily to get him to hand the ball over.

In your family, the stakes may be lower, but the challenges can be similar. It can take a few tries and a number of approaches, but when it is clear that someone else needs to be more involved in the finances, it simply has to get done for the benefit of everyone involved.